Have you ever pondered over the importance of exchange rates for global and national economies? The currency rate is one of the essential drivers of the national economy’s health. There is a constant watch on currency exchange rates since they have a significant influence on many economical levels. Also, they have a huge impact on investors’ portfolios. So, let’s take a closer look at the matter.

Forex market and commodities

There is a strong correlation between the commodity markets and exchange rates. A good example would be the correlation between the price of a USD and oil price. Or a positive correlation between the price of gold and the Aussie dollar. The Canadian dollar has a positive correlation with oil prices and so on. Oil price goes up, and CAD goes up too.

The volatility of exchange rates

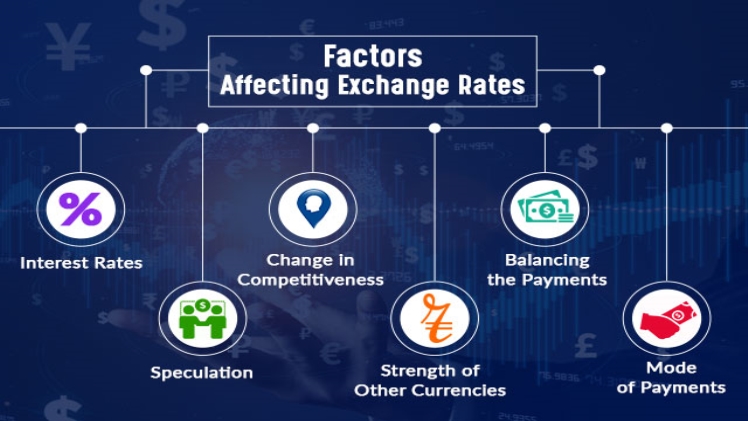

Many factors drive the exchange rates and make some of the currencies more stable while the others are highly volatile. Volatility should not always be considered a bad omen. Foreign currency traders, in fact, reap tremendous profits from it. The currency exchange brokerage business is highly lucrative as well as trading. If you are searching for the opportunity to profit from currency volatility, it has never been easier, thanks to ECN brokers. But before even starting, make sure to read the broker review to check the trading conditions.

Correlation between interest rates and exchange rates

There is a high correlation between interest rates and exchange rates. Whenever the interest rates change, we can expect their impact on inflation and its currency value. The rise in interest rates increases the remuneration of assets denominated in the relevant currency. … For example, in the event of a rise in rates in the United States, this theoretically allows the dollar to appreciate against other currencies.

The Inflation Rate, exchange rates, and foreign trade

Changes in the exchange rate inevitably have effects on consumer prices in an open economy.

The exchange rate directly influences inflation through imported goods and indirectly the real economy through foreign trade.

The depreciation of the currency stimulates both domestic and foreign demand for domestic products. On the one hand, the increase in the price of imported products leads to an increase in external demand, which in turn exerts upward pressure on domestic prices. On the other hand, the depreciation of the national currency makes export products more competitive, the price of which in foreign currency automatically decreases.

As demand increases, the price of exportable domestic (domestic) products is in turn likely to rise, adding to the upward pressure already exerted on domestic prices by increasing prices of imported goods. The increase in demand for external products also leads to an increase in demand for labor and, perhaps, increases in wages which will, in turn, be reflected on prices.

Dependence of exchange rates on monetary policies

However, the bottom line is that inflation ultimately depends on monetary policy, and changes in the exchange rate are dependent on the stance of monetary policy. A monetary policy focused on controlling inflation does not allow changes in the exchange rate to degenerate into an inflationary spiral. Admittedly, a depreciation of the national currency results in the short term by increasing the inflation rate. But in the long period, this rate returns towards the targeted objective.